Trade Finance Alternatives for Startups: Fueling Your Global Ambitions

Let’s be honest. For a startup, the world of international trade can feel like an exclusive party you haven’t been invited to. The traditional gatekeepers—the big banks—often look at your short credit history and politely, yet firmly, show you the door. They want years of financials, substantial assets, and a track record you simply don’t have yet.

But here’s the deal: your innovative product deserves a global stage. You need to pay suppliers upfront, manage long shipping times, and reassure new customers—all without strangling your cash flow. So, what do you do when the old-school methods don’t work? You get creative. You find another way in.

Why Banks Say “No” and What You Can Do About It

It’s not necessarily that banks are the villains in this story. They’re just risk-averse by design. Their models are built on predictability, and startups are, well, the opposite of predictable. Your lack of collateral and financial history is a red flag for them. It’s like asking someone to lend you their car when you just got your learner’s permit.

This funding gap, however, has sparked a revolution. A whole ecosystem of alternative finance has sprung up, tailored for the agile, the new, and the ambitious. These options understand your reality.

The Modern Toolkit: Your Trade Finance Alternatives

Gone are the days when a letter of credit from a major bank was your only option. Today’s landscape is diverse, offering solutions that fit different stages of your trade cycle.

1. Purchase Order (PO) Finance: Turning Orders into Cash

Imagine this: you land a huge, game-changing order from a major overseas retailer. You should be celebrating, right? But then the panic sets in. You don’t have the cash to produce or buy the goods to fulfill it.

PO finance is your lifeline. A lender steps in and pays your supplier directly so you can get the order produced. Once you deliver the goods and invoice your customer, the lender gets repaid from the proceeds.

Best for: Startups with confirmed, large purchase orders from creditworthy customers but lacking the working capital to deliver.

2. Invoice Financing (Factoring): Unlocking Cash Trapped in Invoices

You’ve shipped the goods. The invoice is sent. Now you face the dreaded 30, 60, or even 90-day wait for payment. That’s a long time when bills are due.

With invoice financing, you sell your outstanding invoices to a factoring company. They give you a large chunk of the total—usually up to 90%—almost immediately. You get the cash flow to keep moving, and they handle the collection. It’s like a financial time machine.

Best for: B2B startups with reliable customers but long payment terms that are causing cash flow crunches.

3. Supply Chain Finance (Reverse Factoring)

This one’s a bit different—and clever. Instead of you initiating the finance, your customer does. In a supply chain finance program, your large, creditworthy buyer agrees to pay their invoices to you early through a financier. You get paid quickly, and the buyer gets more time to pay. It’s a win-win that strengthens your relationship.

Best for: Startups that are suppliers to large, established corporations that have such programs in place.

4. Crowdfunding and Revenue-Based Financing

Think beyond traditional debt. Platforms like Kickstarter or Indiegogo can act as a form of trade finance—you’re essentially pre-selling your product to fund its production. No debt, no equity given up, just market validation and cash.

Then there’s Revenue-Based Financing (RBF). Investors provide capital in exchange for a small percentage of your ongoing monthly revenues. It’s flexible. When you have a slow month, your payments are lower. It aligns your success with theirs.

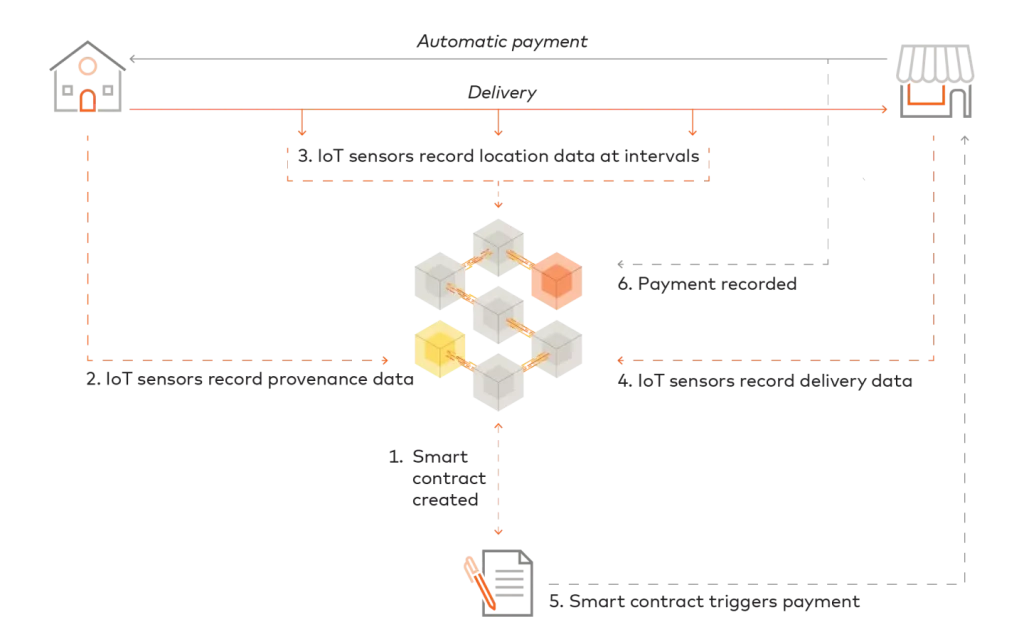

5. Digital Trade Finance Platforms

This is where the future is headed. A new breed of fintech companies has digitized the entire process. They use data—not just dusty financial statements—to assess your creditworthiness. The application is online, the approval is faster, and the experience is, frankly, designed for humans.

These platforms often offer a blend of the options above, wrapped in a user-friendly interface. They speak your language.

A Quick Comparison at a Glance

| Alternative | How It Fuels You | Ideal Scenario |

| PO Finance | Funds production of a specific, large order | You have a big PO but no cash to make the goods. |

| Invoice Financing | Advances cash on invoices you’ve already issued | You’re waiting 60+ days for payment from clients. |

| Supply Chain Finance | Your customer enables early payment | You sell to large corporations with strong credit. |

| Crowdfunding / RBF | Funds via pre-sales or a share of future revenue | You have a consumer product or predictable revenues. |

| Digital Platforms | Fast, data-driven access to multiple solutions | You need speed, transparency, and a digital-first approach. |

Choosing Your Path: A Few Things to Ponder

It’s not just about picking an option from a menu. You need to look at your own business—really look at it. What’s the actual pinch point? Is it a one-off giant order, or is it a constant, grinding cash flow issue from long payment cycles?

And of course, cost is a factor. These alternatives aren’t free. They can be more expensive than a traditional bank loan… if you could get one. You have to weigh the cost of capital against the cost of not taking the order, or not growing. Sometimes, paying a bit more for financing is the price of scaling rapidly.

Start building your financial story now. Even without a long history, clean books, clear records of your contracts, and a solid business plan can work wonders. It shows you’re serious. It’s about building trust, not just presenting numbers.

The Bottom Line: Your Global Playbook is Waiting

The barriers to global trade are crumbling, not because the banks have changed, but because the tools have evolved. The old gatekeepers have been joined by a crowd of new builders—constructing bridges exactly where you need to cross.

Your startup’s potential is no longer limited by a lack of a 10-year financial history. It’s limited only by your awareness of the new routes available. So, the real question isn’t “Can I get trade finance?” The question has become, “Which creative path will fuel my journey?”